No Monthly Service Fee

Experience the freedom of banking with us, where there's no monthly service fee to weigh you down, allowing you to manage your finances hassle-free.

No Minimum Balance

Embrace the simplicity of banking with us, where there's no minimum balance requirement, empowering you to focus on your financial goals without constraints.

No ATM Fees*

Discover the convenience of banking without worrying about ATM fees, ensuring easy access to your funds at our convenient ATM locations.

Earn Rewards

Unlock the benefits of our daily rewards program, where you earn 2 cents on every purchase, with rewards credited to your account the next business day, making every purchase a rewarding experience.

Digital Banking

Experience the convenience of managing your finances anytime, anywhere with our online and mobile banking services. Download the TFCU Pocket Branch app from the Android & Apple stores to enjoy 24/7 easy access to your account.

E-Statements

Swipe. Earn. Repeat.

Choosing a Checking Account Shouldn't Feel Frustrating

Our Daily Rewards Debit account include features to help simplify your banking anywhere, anytime.

ONLINE & MOBILE

DEBIT MASTERCARD WITH DEBIT REWARDS

With TFCU’s Purchase Rewards program, account holders can earn cash back on purchases made with a TFCU Debit Mastercard.

Your Initial Deposit

An initial deposit of at least $25 is required to open credit union checking or debit accounts. You are eligible for membership if you reside or work in the following Florida counties: Miami-Dade, Broward, Palm Beach, St. Lucie, Martin, Hendry, Collier, Lee or Sarasota.

Direct Deposit

If you are planning to set up direct deposit to your new account, you will need to provide your payroll department or Social Security with TFCU's ABA Routing Number #267077847 and your TFCU account number.

What You Need

Whether you open an account online or at a local South Florida branch, you will need a valid form of identification such as a US passport or State-issued Driver’s License. If adding a beneficiary, their date of birth and social security number are required.

Disclosure

TFCU will deposit the $1 minimum requirement to open your account.

You Can Feel Good About Banking

Join thousands of others across South Florida who feel good about banking with a better checking account.

Get Answers to Common Florida Checking Account Questions

-

Checking Account FAQs

-

How Do I Report a Lost or Stolen Debit Card?

To report a lost/stolen Debit MasterCard or ATM card, call 800-472-3272.

-

How Can I Cancel or Stop Payment on Check or a Transaction Coming Through My Account?

Please call our Call Center at 305-261-8328 or 888-261-8328 Monday through Friday 8 am - 6 pm, and the correct form will be e-mailed to you.

-

How Do I Reorder Personal Checks?

Checks can be ordered through Online Banking under ADDITIONAL SERVICES, select check Re-order, in a Branch, or by speaking with a Call Center representative. For first-time check ordering please visit a Branch or call our Call Center at 888-261-8328. You will receive your checks in 7 to 10 business days.

-

What Is Tropical Financial Credit Union’s Routing Number?

TFCU’s ABA Routing Number is 267077847. You will need this number if you are setting direct deposit with a TFCU checking or debit account.

-

Where Can I Find a TFCU Direct Deposit Form?

Direct deposit forms can be obtained in TFCU branches or by filling out this online form

-

Helping Others Feel Good About Banking

I went to TFCU to obtain a new debit card because they sent me one that got lost in the mail. I entered the Kendall branch and sat with Ms. Benitez. She was friendly, cordial and genuinely concerned with my issue. Her service was second to none and she expedited my card without issue. In a time when customer service is almost non-existent, she renewed my faith in good people, quality service and customer satisfaction. Thank you!

O. Han

Kendall, FL

Always friendly professional and meeting the expectation & Personalized service.

Chet

West Palm Beach, FL

I was recommended by a relative of mine to open an account at Tropical in which I did. Mr. Shane - continue being that great representative that you are, very well spoken and well mannered, and the young lady at the teller too was very nice 👏 THANK YOU FOR HAVING ME TROPICAL FINANCIAL CREDIT UNION; KEEP UP THE GREAT WORK 👍

Moline

Miami Gardens, FL

*An additional Fee may be charged by the financial institution providing the ATM

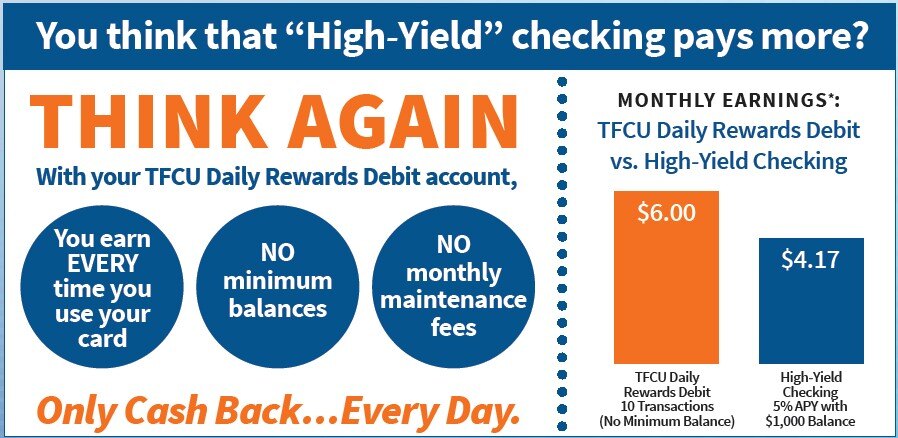

**Rewards are credited to your account the next business day. The monthly earnings of $6 for daily rewards debit assumes that there is 10 daily transactions or a total of 300 transactions monthly at 2 cents. The earnings could be more or less contingent on the number of transactions monthly. The comparison with the high-yield checking assumes a monthly earning of $4.17 given that there is a minimum account balance of $1000 with an APY of 5%. See Schedule of Fees. Other conditions may apply.